You’re a business owner who’s decided it’s time to hire an agency to collect on your past-due accounts. But finding one that’s right for you can be confusing and stressful.

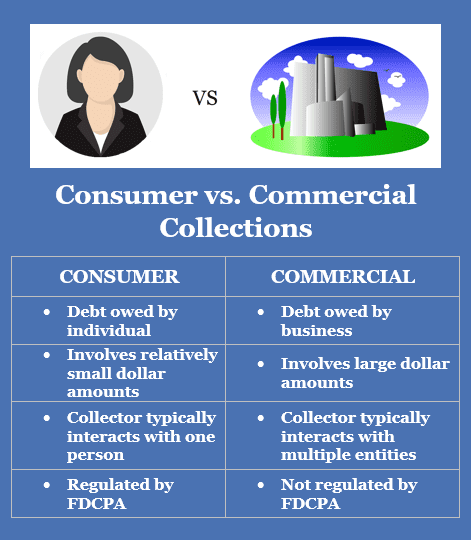

First of all, should you retain a consumer collection agency or a commercial collector? It’s important to know the differences between the two, as they are significant.

Consumer Collections Explained

Whenever an individual owes money to a business, the business may hire a consumer collection agency to locate the individual consumer and encourage him or her to pay the debt. Typically, the amount of the consumer debt is considerably smaller than that which is owed in a business-to-business (i.e., commercial) transaction.

Consumer collection efforts are regulated by the Fair Debt Collections Practices Act (FDCPA). This federal law was enacted by Congress in 1977 to protect consumers from abusive third-party debt collection practices. The FDCPA establishes collection guidelines, defines consumer rights, and stipulates penalties for violations.

Consumer collection efforts are regulated by the Fair Debt Collections Practices Act (FDCPA). This federal law was enacted by Congress in 1977 to protect consumers from abusive third-party debt collection practices. The FDCPA establishes collection guidelines, defines consumer rights, and stipulates penalties for violations.

In addition, most states have their own debt collection laws. Some of these mirror the FDCPA. But some offer even more protection to consumers. For instance, California’s Rosenthal Fair Debt Collection Practices Act expands the definition of “debt collector” to include the original creditor.

Commercial Collections Explained

Commercial collections, on the other hand, involve the recovery of unpaid business debt owed to another business. This commercial debt is usually incurred when the debtor-business fails to pay the creditor as per the terms and conditions of a legally binding contract.

With much larger amounts involved, failure to pay commercial invoices can significantly impair a company’s cash flow, preventing them from paying their own vendors, even forcing them to halt production. Also, more entities are typically involved in the commercial debt recovery process (e.g., Accounts Payable personnel credit managers.

Commercial collection agencies are not regulated by the FDCPA. Even in situations involving a personal guarantor of a business debt, the debt is still not considered to be a “consumer” debt, and so it is not covered by the FDCPA.

Nor are commercial agencies regulated, per se, by any state debt collection laws. However, more than 20 states and several large municipalities currently require resident commercial collection agencies to be licensed. And in some jurisdictions, they must be licensed in the states in which they collect.

How Are Commercial Collections Regulated?

The Legal Advantage

Commercial collection agencies alone are limited in their debt recovery options. Typically, they only send letters and place telephone calls.

Most creditors seeking overdue payment have already issued their own collection letters and made multiple phone calls to the debtor-business. The likeliness that a collection agency alone will be more effective with these efforts is not high.

Also, the more ineffective attempts at collecting the debt, the longer the debtor-business has to hide potential assets.

On the other hand, communications from a commercial collection attorney tend to be taken more seriously — not only because they imply legal action, but they demonstrate the ability to follow through with it.

Even though commercial collection agencies are not governed by the FDCPA, that does not mean their activities are not subject to regulation. The principal body governing the activities of commercial debt collectors is the Commercial Collection Agencies of America (CCAA). While this association is not a government entity, it is nevertheless responsible for supervising the activities of commercial debt collectors.

In order to become a certified member of the CCAA, agencies must abide by high standards of practice and uphold strong ethics. Not only are aggressive and unethical tactics prohibited, but prospective CCAA members must meet rigorous certification criteria.

Do Your Research

It’s up to creditors themselves to research prospective agencies to ensure that both they and their debtors receive the highest standards of service when collecting on commercial accounts.

For instance, some collection agencies collect on both consumer and commercial accounts. But with such significant differences between the two, your company is much better served by selecting an agency that specializes in the type of debt you need to collect. Specialized agencies are usually more successful in recovering funds than those who handle both types of debt collection.

Also, because licensing is complicated and expensive, some collection agencies opt to forgo it. The negative ramifications of using an unlicensed agency can be serious. For one thing, a debtor-business owner who learns that your agency is unlicensed would likely avoid paying. (Wouldn’t you?)

Creditors Adjustment Bureau collects only on commercial accounts, and we’re licensed and bonded in all U.S. states and municipalities that require it.

Sources:

Featured Image: Adobe, License Granted

Federal Trade Commission

Commercial Collection Agencies of America

Business News Daily