A Simple Way to Protect

Your Security Interest

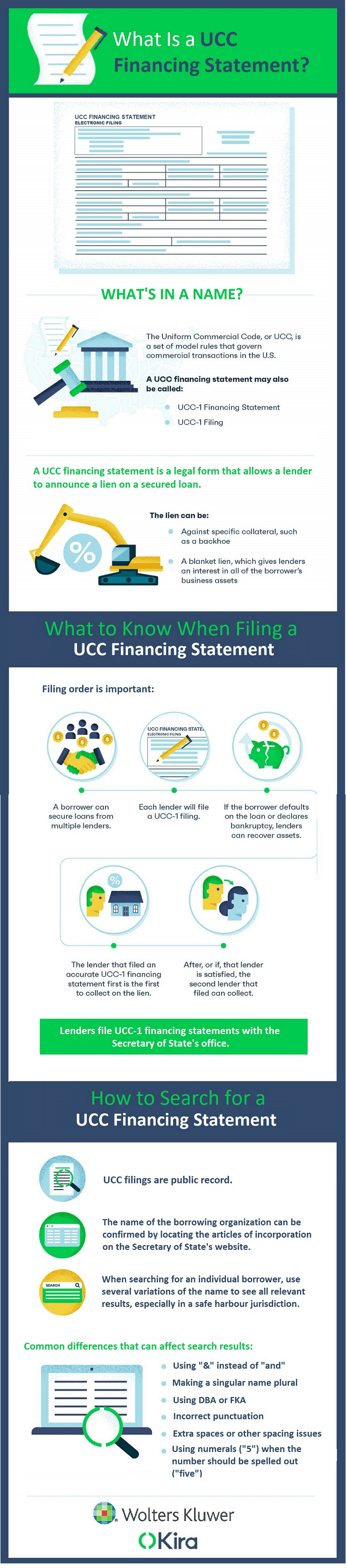

Does your business provide credit to customers? Then you should know about UCC filings. Let’s start at the beginning.

What Is the UCC?

The Uniform Commercial Code (UCC) was established in 1952 as a means to consistently govern commercial transactions across the U.S. It specifically addresses the following areas:

Sales

Sales- Leases

- Negotiable Instruments

- Bank Deposits and Collections

- Funds Transfers

- Letters of Credit

- Bulk Transfers and Sales

- Documents of Title

- Investment Securities

- Secured Transactions

What Is a UCC Filing?

A UCC filing (sometimes called a UCC-1 or UCC-1 Financing Statement) pertains to secured transactions. The filing provides public notice of a security interest in a particular asset owned by a particular debtor. The UCC-1 protects a lender’s interests in case the asset owner files for bankruptcy or defaults on the debt. Should that occur, the lender may seize and/or sell the secured property.

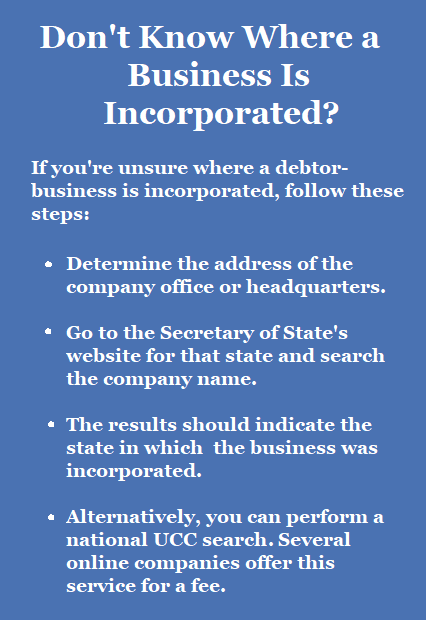

A UCC-1 is filed with the Secretary of State’s office in the state of the debtor’s residence or the state in which debtor-business is incorporated. (Forms are available online through the various SOS offices.) Because it is filed through the SOS, a UCC-1 is considered a legally binding instrument.

The UCC-1 is a fairly simple form, containing only three pieces of information:

- The Debtor’s name and address

- The Creditor’s name and address

- A description of the secured property

In order to remain active, a UCC-1 must be renewed every five years.

Conducting a UCC Search

Before extending credit to a customer in a secured transaction, you should first determine if any UCC liens have been placed on the secured property. You can conduct a UCC search through the SOS website in the relative state. When performing the search, it’s important to enter the debtor’s correct legal name, as well as any former names that may have been used.

–Article Continues Below–

If you find that the secured asset already has one or more UCC liens filed against it, you’ll need to decide if you extending credit to that customer is worth the risk. Lenders with the oldest UCC-1 filings have the highest priority claim to the secured property. This is why many high-profile lenders won’t file a UCC lien after that of another lender.

Why File a UCC-1?

Of course, the vast majority of people and businesses to whom you extend credit fully intend to repay you. But sometimes things happen which they cannot foresee. If your debtor or debtor-business is unable to repay the debt, you could lose all or part of the secured collateral, if you’re not protected.

The UCC-1 provides that protection by establishing you as a secured party. In the event the debtor defaults, you have a “place in line” when the collateral is divided among all the parties.

The UCC-1 provides that protection by establishing you as a secured party. In the event the debtor defaults, you have a “place in line” when the collateral is divided among all the parties.

Secured creditors are positioned at the front of that line (just behind the IRS and other government entities.) Which means your chances of recovering at least a portion of what you’re owed are much greater.

On the other hand, if you haven’t filed a UCC-1, you’re considered to be an unsecured creditor — sending you to the back of the line in the event of a default.

How to File a UCC-1

As previously mentioned, the UCC-1 should be filed with the SOS office in the state where the debtor resides (if an individual) or is incorporated or otherwise organized (if a business). If the secured property is real estate, you should also file the UCC-1 with the recorder’s office in the county where the property is located.

All 50 SOS offices maintain websites that accept online filings, including UCC filings. These sites also provide the necessary forms for you to download and complete, as well as detailed instructions.

A national UCC-1 form is also available to download. However, some states require that the state form be used, so be sure to look there first. When completing the form, follow all instructions carefully, paying particular attention to proper use of the debtor’s correct legal name and full address.

(The infographic above offers some helpful tips.)

Sources:

Featured Image: Adobe, License Granted

Nav

Wolters Kluwer

Fast Capital 360